Irrespective of the shenanigans and political goings on in Westminster recently, the housing market (for the time being anyway) shows a striking resilience, fostered by the on-going wide-ranging monetary policy by the Bank of England. With interest rates and unemployment low, UK plc is heading into 2020 in reasonable condition. Additionally, despite the UK’s new homes industry Continue reading The £3.6 billion mortgage debt of Fife homeowners

Month: January 2020

It takes just eight minutes to decide on a house

As any estate agent can tell you, a successful sale hinges on a good first impression. Prospective buyers possess a sixth sense when it comes to viewing a property and if things aren’t up to scratch – inside and out – you can guarantee they will spot it.

In fact, a recent study has revealed that the average house hunter only needs eight minutes to decide if a property is for them or not and six in ten adults will also choose not to buy a property based on the condition of the exterior of the property, without even needing to view the inside.

In comparison, 18% of buyers admitted to buying the very first property they view and 15% said they decided to buy the property before they had even viewed it in person.

This decisiveness extends online, with the average buyer spending eight minutes deciding whether or not to visit a property – highlighting the importance of a good online advert. This comes back to making sure you have a professional photographer to take stunning photos, a professional copywriter to describe and measure the property, emotive descriptions to catch the buyers attention, a correct and not over-inflated valuation for the home report and most of all an agent that’s going to jump on an enquiry regardless of when and what time it comes in. Proactive rather than reactive.

75% also confessed to being irritated upon finding that an advert or online listing does not accurately represent a property when visiting in person.

The study also revealed which aspects of a viewing signalled an early exit for many prospective buyers. The main offender was an obvious damp patch, which 60% of buyers said would put a stop to any future transaction, whilst a house on a main road or cracks in the wall would also put an end to the viewing.

For the buyers who are good at seeking out the problematic finer details of the property, there were some decisive reasons for buyers backing out of the viewing, such as dirty toilet pipes, overflowing bins, wheelie bins left in front of the property and faded or yellowed paintwork.

Some viewers take issue with a sellers lack of preparation for the viewing such as untidy rooms, poor DIY and ashtrays left around the house.

Other reasons included logistical problems such as the size of the rooms being too small for the buyer’s furniture or issues with the natural lighting of the property. The current owner’s furniture cluttering up the layout of a room which preventing the buyer’s imagination from running wild led to over a third of buyers to back out of a purchase.

The list showcases the importance of sprucing up your home, both before putting it on the market and before every viewing. A prospective buyer needs to weigh up the additional costs and work involved in buying a property, so ensure you give your home the most generic makeover possible and organise your possessions and furniture in a way that won’t distract the prospective buyer.

Some of these issues might seem very minor to you but it highlights the need to have an experienced agent that can overcome what you see as minor objections so the buyer does not walk away over something that could be trivial in hindsight.

Will There Be a ‘Boris Bounce’ For the Fife Property Market?

The Halifax announced in early January that there was a Boris Bounce in the national property market as they stated national property values soared 1.7% in December 2019 – the biggest rise since the 1.9% month on month rise in February 2007 (a few months before the Global Financial Crisis aka the Credit Crunch).

Get the flags out – all hail Boris as the Conservatives gain their landslide general election triumph – the Boris Bounce is here … or is it?

Continue reading Will There Be a ‘Boris Bounce’ For the Fife Property Market?

Tips for Buyers and Sellers looking to move

It’s the start of a brand new year in the market, with buyers and sellers alike preparing to fulfil their New Year’s Resolutions and make their move. Market conditions appear to have stabilised after December’s general election brought with it a majority Conservative Government, but what can you do to give yourself the best chance of a successful transaction? Read our top tips for Buyers and Sellers below.

BUYERS TIPS

Research, Research, Research

As clichéd as it sounds, buyers who prepare sufficiently are more likely to end up with a better deal for the home they’re looking for. Once you’ve made the decision to begin house hunting, look into sale and listing prices for properties in the local areas that you’re interested in; this will give you a rough guide as to how much you can expect to spend.

Prepare your mortgage

If you’re house-hunting in a competitive area where properties are quickly snapped up, then getting a mortgage agreement in principle will give you an advantage when you find the property that you want. Having your finances in order and prepared can save time and prove invaluable if the home you want is likely to generate significant local interest.

Check the Home Report

Make sure you check the home report (Scotland) and the surveyor’s comments before you offer. This survey flags up any major issues or elements of the property that require attention, such as urgent defects or structural concerns. Depending on the age of the building, you could find yourself a wildly fluctuating amount of work to carry out, especially if previous owners have neglected its upkeep. Either way, this is an invaluable belts and braces report of the property and will provide peace of mind in any outcome. If it’s more than 3 months old once you have had an offer accepted, insist on the seller getting a refresh so it’s up to date. If a long time has passed since it was first listed it could be there is other issues you need to be aware of that could affect your initial offer price.

SELLERS TIPS

Research, Research, Research

Preparation is key for sellers, too! Make sure you know your property’s true value before it’s listed; carry out a full appraisal of your home with a trusted agent and not just an instant valuation to get a clear idea of what your property is worth. Inviting valuers into your home can also provide you with a fresh set of eyes which can be useful in flagging up any existing issues or reminding you of a few flaws that could require attention before going to market, too. Some even provide more specialist knowledge than just a valuation.

Find ways to add more value

If you’re looking for ways to add more worth to your property, then carrying out home improvement projects will certainly aid you. These can be relatively simple tasks, such as installing double glazing or adding extra insulation to your loft, or bigger jobs such as renovating your kitchen. Whilst the cost associated with these projects may be off-putting, it may pay off when it comes to increasing your home’s value. But ask the professionals first if it’s worth doing before doing it.

Declutter and organise

Take a look at each room in your house and you’ll likely find a few easy ways of decluttering and making extra space. This is vital for the viewing process as potential buyers need to be able to picture themselves living in this space, and in some rooms, it’s as easy as clearing a few worktops or mantlepieces.

In today’s market, preparation really is key whether you’re buying or selling. Carry out your market research, get your finances and paperwork and make sure you utilise a knowledgeable and local agent to help you through the process. One that has a consistent track record, years of experience and is an expert in their field. One that embraces and uses new technology and media marketing to hit specific target markets for your property rather than one that will put it on a few big websites and hope for the best. Proactive rather than reactive.

OK ‘St Andrews’ Boomer it’s all your fault

St Andrews House Prices Have Risen by 176% as a Proportion of Household Income Since 1980

Have the Baby Boomers (people between the ages of 55yrs to 75yrs) messed things up for the Millennials in terms of getting on the St Andrews property ladder? They bought their own council houses in the 80’s and 90’s, meaning there are no affordable homes for today’s youngsters, thus driving up the demand for rental homes and the price of homes (making them unaffordable). So, I decided to look at the figures, which do not make for good reading.

In 1980, the average St Andrews household income was just under £6,000 per annum and the average St Andrews house price was £25,933; whilst today, the average St Andrews household income is £27,544 per annum, yet the average household value is £328,700, meaning…

the average value of a St Andrews home was 4.32 times more than the average household income in 1980 compared to today, where it is 11.93 times a St Andrews household income

… it’s no wonder then that Millennials are pointing the finger at Baby Boomers!

And the problems don’t just stop there. Not only do the newspapers state there is a housing crisis of affordability, but also a crisis of the availability of homes for people to live in. The political parties using housing as a ‘vote getter’ mentioned stats such as in 1981 there were 5.1 million council houses and today that stands at 1.6 million. This is important because, as a substantial number of people will never be able to afford to buy, social housing plays a significant role in homing them.

It all looks rather damning and the phrase ‘OK Boomer’ looks quite apt.

(The phrase ‘OK Boomer’ become fashionable as it started as a way of showing Baby Boomers that things were “easier in the past”, yet now it has become just a way for younger people to discredit the views of older people).

Well, checking the stats, the political parties seemed to forget the number of housing associations homes (which are also social housing) has risen from 0.4m to 2.6m homes in that time, therefore, whilst there is a drop in social housing, it’s a net figure of 2.3m fewer social-rented houses, instead of the 3.5m in the paragraph above.

Baby Boomers simply did the best they could with the circumstances given – it’s not like that these older generations have been conspiring in the food aisles of Waitrose or M&S on how to mess things up for the next generation. There are fundamental underlying problems in British society that means things are difficult for our younger people – it’s everyone’s responsibility to solve those underlying problems – we can’t just blame the Baby Boomers. Millennials aren’t morally superior to Baby Boomers just because they didn’t grow up in the same era of economic growth and house price inflation.

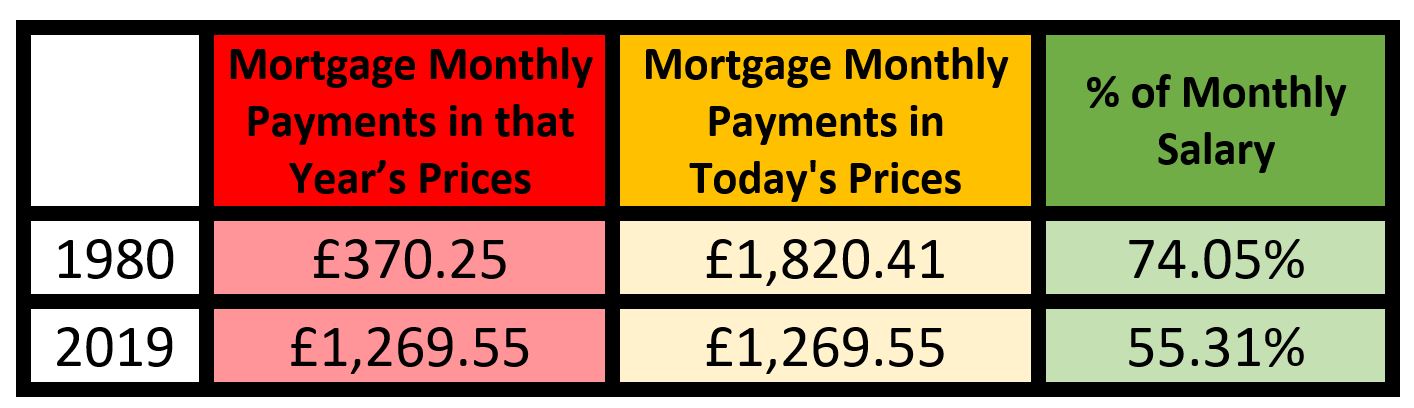

What some people seem to forget is whilst St Andrews property values were lower, so were salaries. The true cost of affordability is the mortgage payments. Assuming an average property was purchased in 1980 and again in 2019, using a 95% mortgage at the prevailing mortgage rate of 17.8% in 1980 and the current 1.65%, today in St Andrews the mortgage accounts for 55% of the household income (assuming a single income) compared to 74% in 1980. This has to be one of the main reasons why many families became two wage households in the late 70’s/early 80’s as housing affordability was diminished with these eye watering high interest rates.

Things were tougher for homeowners in 1980….

The issue here is something much deeper. Baby Boomers say it is the Millennials’ own fault they can’t afford to buy their own home because they spend all their money on three holidays, avocado on toast, going out down the pub 3 times a week and buying the latest iPhone or suchlike whilst Millennials accuse the Baby Boomer generation for ruining the housing market ‘per se’ by being selfish. Both are right and both are wrong.

In my own involvement with friends and family, many St Andrews Baby Boomers are trying their best to help out their now grown up children with a deposit. They are fully aware of current St Andrews house prices compared to when they bought their own homes.

I am not a fan of attaching labels, be it Millennials, Baby Boomer or Gen-X. It’s really a point of attitude and behaviour and circumstance rather than the date of your birth. Every generation has had its fair share of feast and famine and whilst I appreciate the irony of the title of this article, let’s stop labelling people and making assumptions, everyone needs to understand each generation’s issues and be more ungrudging to each other.

Preparing your property for sale in 2020

Time to pack up the decorations, take down the tree and munch down the rest of those leftovers; Christmas is over and 2020 is here! If you’re preparing to sell your property in the New Year, then you might be feeling a little overwhelmed at the amount of work your home requires before taking it to market. But don’t fret; we’re here with a list of top tips to help get you ready to show off your property.

How to nail the first impression

Almost all of the people with an interest in your property will get their first glimpse of what your home can offer in the form of pictures, either in an agent’s window or online. Not only that, but some buyers will drive by your abode to scope out its location and get a feel for it from the outside before they even enquire through the agent. If it’s not ready they might not even enquire as they have been put off before then. With that in mind, making sure your home is visually appealing and attractive will be your biggest priority in preparation for listing.

With that in mind, we’d strongly consider that you take the following into consideration:

- Clean your windows – it’ll be easy to notice if you haven’t!

- Give your front door a lick of paint to freshen it up and make your entrance feel more welcoming, along with a new doormat if yours is looking a little tired

- Tidy up your entrance hall of any post and flyers

- Clear out weeds from your paths and tidy your garden

- Make space on your driveway for visitors to park

- Be honest – hiding less-than-desirable features in the photos won’t help you as potential buyers will see defects when they view your home

Upping your Presentation

The above tips will certainly help to give your property a tidier feel, which is key; an organised home can give buyers a vital opportunity to picture how they will fit into the living space. But if you want to present your home in its best possible light, then consider how you present your home.

- Declutter – a simple suggestion but one that can have a massive impact. Removing large bulky items from view, if only temporarily will have a massive effect

- Let in the light – keep the curtains open, windows clean and any natural sources of light clear to give your home as bright a feel as possible

- A warm place – make sure all rooms are heated prior to viewings, even those you don’t use often

- Bathroom spaces – keep your bathroom and toilets clean, free of mould and tidy, and make sure your toiletries are kept to a minimum.

Time-consuming as it may seem, keeping your home tidy, organised and welcoming will put you in good stead for when those viewings start. Remember; visitors need to imagine themselves in your home!

Prospective tenants: furnished or unfurnished lets?

Furnished properties can vary in the level of furniture and furnishings offered. It is extremely important for prospective tenants to find out exactly what is being included in furnished properties before signing any contracts. When viewing rental properties on the market, remember that the furniture and decor may all belong to the current tenant, and so shouldn’t be the sole decider for signing the contract. Continue reading Prospective tenants: furnished or unfurnished lets?

Our round up for 2019 CHARITIES AND EVENTS

First of all, I can’t thank our customers enough for because they have bought, sold or let a property through us and have made this possible.

This year we have managed to raise and contribute around £15,000 towards local charities and events that help our communities and the people within them.

Here are a few of the projects we have helped. At the end I’ll share some more exciting news about our Fife schools swim and triathlon programme for 2020.

#GIN21 – The event was the idea of a former Madras College, St Andrews pupil to raise awareness of the need for mental health honesty and support, after several pupils tragically took their own lives. Hosted by Eden Gin and ‘The Blackfish’ from Game of Thrones (Clive Russell) at the Old Course hotel it was a superb event. Some photos on the day: https://www.facebook.com/pg/chriswallardphotography/photos/?tab=album&album_id=1165810963567002

#GIG21 – A charity concert to raise money and awareness for young men’s mental health whilst simultaneously supporting those who have been affected by suicide. https://www.facebook.com/events/younger-hall/gig21/1379327615537638/

Sponsorship of the 1st North East Fife Schools Give It a Tri Event – over 550 P6/P7 pupils from 17 North East Fife primary schools had an active morning of running, swimming and cycling in the region’s first triathlon taster day. The event was at Cupar Leisure Centre, thanks to a partnership between Triathlons Scotland, Active Schools and Fife Properties. https://www.fifeleisure.org.uk/news/north-east-fife-pupils-try-out-triathlon/

Contribution to Kingdom Off Road Motor Cycle Club – A registered charity that provides access to equipment and off-road riding for young people from the disadvantaged areas; its main objective being to contribute to safer communities by reducing the current anti-social and illegal use of off-road motorcycles. I’ll let comedian Russell Howard and David Paton tell you more: https://www.facebook.com/OfficialRussellHoward/videos/1877130825764357/UzpfSTIzMjYzMTI3MzU0NTMyOToxODQ5MDgxODk1MjMzNTg0/

Main sponsorship of the Annual Fife Properties Lochore Triathlon Festival. – Now one of the biggest events in Scotland in the Triathlon Calendar with over 500 entrants. 200 Sprint Triathlon, 200 Standard Triathlon and most important over 100 Tristars (young children) which we want to grow and encourage more children to take part. https://www.triathlonscotland.org/event/lochore/

Chariots of Fire Beach Race got an extra special stocking filler this morning (25th December 2019) – When we stepped in to top up the total raised for their charity from this year’s race and ensured the sum comes to the AMAZING total of £10,000!!! https://www.facebook.com/ChariotsofFireBeachRace/

Became a sponsor of Enigma Gymnastics. One of the only clubs in Scotland to have a fully inclusive policy for young people with all abilities to take part in gymnastics: http://www.enigmagymnasticsclub.co.uk/

Sponsors of the University of St Andrews Spring Triathlon and Autumn Duathlon. The students involved in Triathlon run these 2 events to raise money for local charities every year: https://www.facebook.com/pg/UStATriathlon/about/?ref=page_internal

Sponsors of the 2 youth events (Family beach Event and Painting Competition) at the Largo Arts Festival https://www.largoartsweek.com/

Sponsors of Leven Runfest. The event was Leven’s first major running event with hundreds of people taking part in the inaugural Leven Runfest, either by running the 5k or 10k events or supporting the competitors. https://www.brag.co.uk/leven-runfest-2019/

Sponsors of Silverburn Music Festival which raises money for Silverburn Trust https://www.silverburnpark.co.uk/home

Finally we managed to raise over £2,500 for Chest Heart and Stroke Scotland. This was a really personal cause for me which evolved to a wider audience when I realised how many of us have lost so many loved ones to these illnesses. https://vlm19.everydayhero.com/uk/in-memory-of-a-dear-friend

So, 2020 brings an exciting year as we have committed to 8 projects so far:

In conjunction for Triathlon Scotland and Fife Leisure Trust we are going to sponsor the next wave of P6/P7 North East Fife Primary Schools in a triathlon taster session plus we are rolling this out to all the Primary Schools in the Levenmouth Area. This will ensure around 1,000 P6/P7 pupils in 2020 get to try Triathlon for the first time. I firmly believe that sport is an excellent way to get young people active in body and more importantly in mind. Giving them a boost in confidence and well being and showing them not to be afraid and if they set their mind to it they could accomplish a lot more than they think.

Main sponsors for the St Andrews Spring and Autumn Duathlon.

Main sponsors for Scotland’s biggest Triathlon event. The Lochore Triathlon Festival and the further sponsorship of the Lochore Off Road Triathlon in August.

Sponsoring Enigma Gymnastics

Sponsoring Leven RunFest so we can get even more people running.

I’ll be climbing the Highest Peak in Europe (over 5,600m) Mount Elbrus https://en.wikipedia.org/wiki/Mount_Elbrus to raise money for Kingdom Off Road Motorcycle Club.

Working with several partners to bring a major cycling event to Fife

And one of the most exciting projects. We are currently running a pilot program with Fife Leisure Trust and Parkhill Primary to see if we can re-establish the project that will make sure every Fife Primary school pupil can swim to a certain standard before they go to Secondary School.

All this is possible because of people like yourself that chose to use our services and the more people that do the more we can do in future.

We are by no means a big company but I personally feel that we should continue to reinvest in our communities when we can so thank you for your continued support and please tell as many people about us as possible.

Word of mouth is the best and most cost effective method of advertising our business and services.

Regards

Jim Parker – Managing Director