Host Jim Parker is joined by Andrea Stanford and Richard Cook to discuss this week’s news in the Fife Property Market while answering questions live on their show every Saturday morning @ 9.30am. Link to today’s article: Continue reading Fife Properties TV (S1 EP 9) Fife First-time Buyers are Being Locked Out of the Fife Property Market

Tag: Tenant

Fife Buy to Let – Past, Present and Future

Investing in a Fife buy to let property has become a very different sport over the last few years.

In the glory days of the five years after the turn of the Millennium, where we had double-digit house price growth, mortgage companies (notably Northern Rock, HBOS and their ilk) desperate to get on the buy to let mortgage bandwagon with rates so low it would make the belly of a snake seem high and an open mildness to give loans away with not so much more than a note from your Mum and with hardly any regulatory intervention… anyone could make money from investing in property – in fact it was easier to make money than fall off a log! Then we had the unexpected flourish of the property market, with the post credit crunch jump in the property market after 2010, when everything seemed rosy in the garden.

Yet, over the past five years, the thumbscrews on the buy to let market for British (and de facto) Fife investors have slowly turned with new barriers and challenges for buy to let investors. With the change in taxation rules on mortgage relief starting to bite plus a swathe of new rules and regulations for landlords and mortgage companies, it cannot be denied some Fife landlords are leaving the buy to let sector, whilst others are putting a pause on their portfolio expansion.

With the London centric newspapers talking about a massive reduction in house prices (mainly in Mayfair and Prime London – not little old Fife) together with the red-tape that Westminster just keeps adding to the burden of landlords’ profit, it’s no wonder it appears to be dome and gloom for Fife landlords … or is it?

One shouldn’t always believe what one reads in the newspaper. It’s true, investing in the Fife buy to let property market has become a very different ballgame in the last five years thanks to all the changes and a few are panicking and selling up.

Fife landlords can no longer presume to buy a property, sit on it and automatically make a profit

Fife landlords need to see their buy to let investments in these tremulous times in a different light. Before landlords kill their fatted calves (i.e. sell up) because values are, and pardon the metaphor, not growing beyond expectation (i.e. fattening up), let’s not forget that properties produce income in the form of rent and yield. The focus on Fife buy to let property in these times should be on maximising your rents and not being preoccupied with just house price growth.

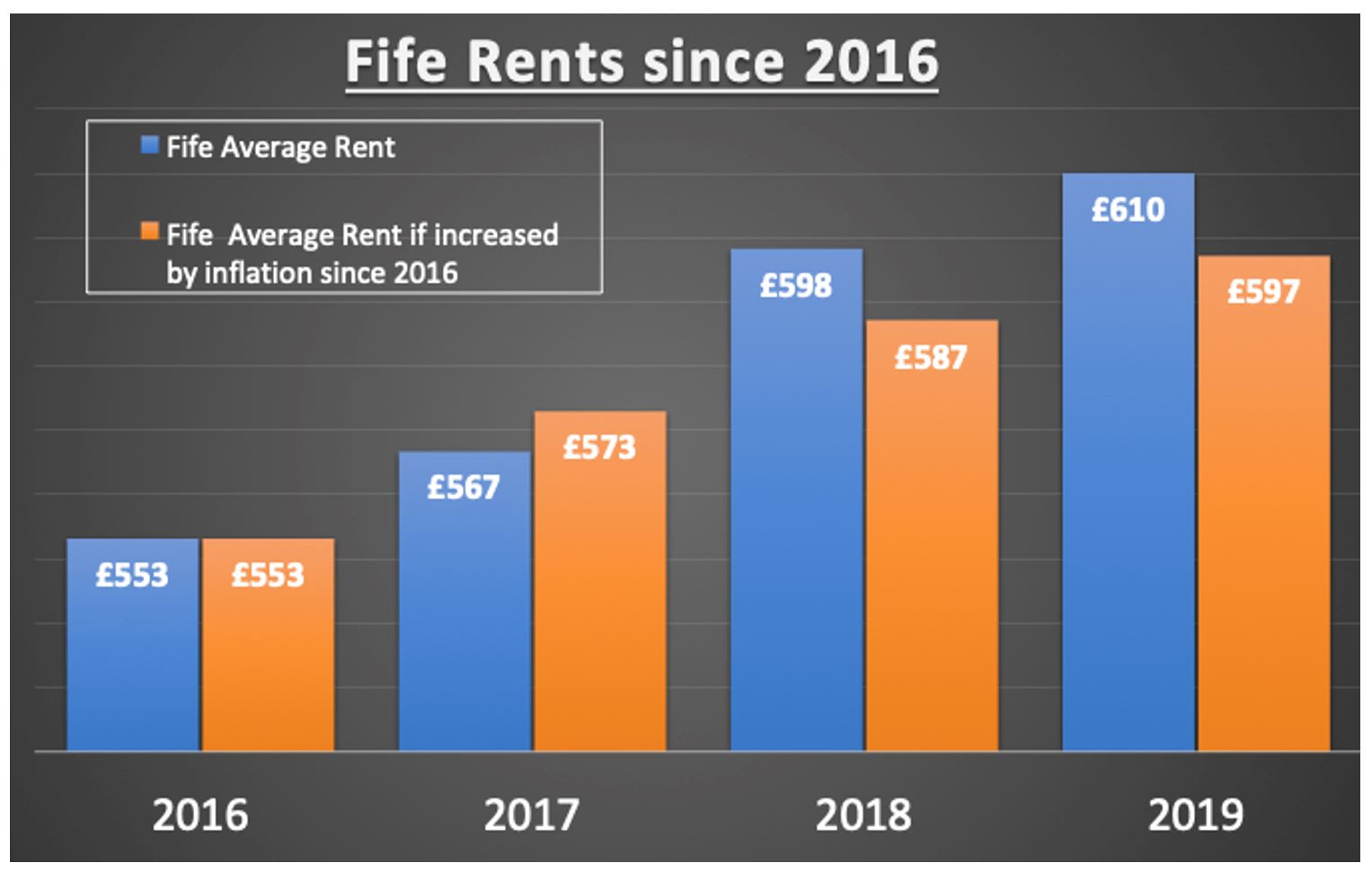

Rents in Fife’s private rental sector increased

by 1.96% in the past 12 months

Rents in Fife since 2008 have not kept up with inflation, it is cheaper today in REAL TERMS than it was 11 years ago and some landlords are beginning to realise that fact with our help.

Looking at the last few years, it can be seen that there is still a modest margin to increase rents to maximise your investment (and it can be seen some Fife landlords have already caught on), yet still protect your tenants by keeping the rents below those ‘real spending power terms’ of the 2008 levels.

Buy to let must be seen as a medium and long-term investment ….

Rents in Fife are 10.28% higher than they were 3 years ago and property values are 11.04% higher than Jan 2016

…and for the long term, even with the barriers and challenges that the Government is putting in your way – the future couldn’t be brighter if you know what you are doing.

Investment is the key word here… In the old days, anything with a front door and roof made money – yet now it doesn’t. Tenants will pay top dollar for the right property but in the right condition. Do you know where the hot spots are in Fife, whether demand is greater for 2 beds in Fife or 3 beds? Whether town centre terraced houses offer better ROI than suburban semis? With all the regulations many Fife landlords are employing us to guide them by not only managing their properties, taking on the worries of property maintenance, the care of property and their tenants’ behaviour but also advising them on the future of their portfolio. We can give you specialist support (with ourselves or people we trust) on the future direction of the portfolio to meet your investment needs (by judging your circumstances and need between capital growth and yields), specialist finance and even put your property empire into a limited company.

If you are reading this and you know someone who is a Fife buy to let landlord, do them a favour and share this article with them – it could save them a lot of worry, heartache, money and time.

Prospective tenants: furnished or unfurnished lets?

Furnished properties can vary in the level of furniture and furnishings offered. It is extremely important for prospective tenants to find out exactly what is being included in furnished properties before signing any contracts. When viewing rental properties on the market, remember that the furniture and decor may all belong to the current tenant, and so shouldn’t be the sole decider for signing the contract. Continue reading Prospective tenants: furnished or unfurnished lets?

Traditional estate agents found to be good value for money

With recent changes to the landscape of estate agency, including online-only providers and new fee structures, it may come as a surprise to some to see that traditional estate agents are considered good value with regards to fees and value-for-money, estate agent comparison site GetAgent has found.

The review site has found that 84% of home sellers who purchased a property over the last year decided to use a traditional estate agent, with 69% of those feeling that the fee which they paid was good value for money. It would seem, therefore, that when making one of the biggest decisions that many of us will ever make, the traditional method of building a relationship with an agent who then leads you through the buying or selling process is still heavily favoured.

Colby Short, founder and chief executive of GetAgent, said: “We’ve seen some big changes to the sector over the last decade through the rise and fall of the online agent and this consumer learning curve has led to an adjustment in opinion when it comes to the fee charged to sell a home.

“While a low fixed fee may have seemed like the future of home selling and many may have sold successfully via that model, a number of high-profile company collapses along with a consistent string of customer service failures has seen the market share of online agents fail to live up to expectation.

“Previously, the commission fee charged by traditional agents was seen as too high, I think the consumer is now starting to realise that you get what you pay for.

“To pay a few thousand pounds in commission to achieve a higher sold price while securing a buyer in current market conditions is ultimately much better value for money than a few hundred up front and no sale achieved at the end of it.

“Of course, the current lethargy plaguing the market is not ideal and has evidently had an impact on the price achieved and the time it’s taking to sell, but I think it has helped demonstrate the worth of a good estate agent which is a silver lining for the industry at least.”

Fife Properties Group Office Owner, Jim Parker commented: “I agree. Choosing an Estate Agent to sell your house will probably be one of the most important things you will ever do. While fees are important what is equally important is the end result. Having an Estate Agent that can demonstrate the ability to achieve more than the asking price on consistent basis could far outweigh trying to save a few hundred pounds in fees at the beginning. We have that track record”

Fife Properties currently offer a FREE initial consultation service which not only provides an idea of the current value of your property but gives extremely useful advice on maximising the value when selling. To book click the link: https://www.fifeproperties.co.uk/property-valuation/

How to become a buy-to-let landlord (3 min read)

Bricks and mortar have always been a bolthole for people looking to invest their money in a safe place and, despite recent changes to the lettings market, buy-to-let remains a popular investment avenue. If you are looking to become a buy-to-let landlord, then the results can be fruitful – follow our five tips below to start your journey!

Mortgage Matters

The first port of call if you are considering becoming a buy-to-let landlord is the mortgage market; either with your current mortgage provider if you are looking to convert a current mortgage into buy-to-let, or to the general marketplace if you are looking to buy a new property for lettings purposes. Ensure that you shop around for your buy-to-let mortgage as the marketplace is currently extremely competitive in terms of lending, which should help you to obtain favourable rates. If you are converting your mortgage, ensure that your lender has granted you “Consent To Let” before you move any tenants into the property.

Managed or Unmanaged?

With the recent surge in tenant and landlord legislation, managing your own property may seem like a daunting prospect. If this is the case, then look for a reputable estate agent who will manage the lettings process for you – this will take a lot of the stress out of letting a property for you. If you are more confident, then you may want to work with an agent to list your property and find tenants, but then manage those tenants independently – if this is the case then seek as much advice as possible and keep legislation at the top of your list as a landlord.

Landlord Insurance

When it comes to buy-to-let properties, you will need to make sure that you are covered for every eventuality. Specialist landlord insurance is a must, as well as buildings insurance, and if you have furnished a property then contents insurance may also be required. Speak to your chosen estate agent about their recommendations in terms of insurers and remember that spending a little on comprehensive cover may save you a lot in the long run.

Financials

Once you have your buy-to-let mortgage in place, you have your tenants in a fully-insured property and you are reaping the rewards, one of the key steps will be filing your taxes correctly. With buy-to-let being an investment source, you will have to pay specific taxes regarding the property and the profit which you are making from that; speaking to an accountant will help you to get your finances in order. Further to this, you will be able to offset some of your expenses and costs against tax – don’t miss out on these opportunities.

Target Market

It would be easy once you have your investment property in place to then sit back and relax. One of our recommendations would be to keep your finger on the pulse of the lettings market and adapt your property accordingly. Currently, the student lettings market is extremely popular and the potential rental yield extremely high, therefore it could be a good market to position your property within currently. As the economy changes, families may be the driving market in lettings, or indeed young professionals, therefore stay flexible with your offering and you may well be able to increase your portfolio.

Fife Properties Lettings Director, Richard Cook commented: “This is a market that we are leading in and with over 50 years of combined experience and track record it speaks for itself. Letting a property is not for the faint-hearted because it is not about getting the tenant in the property it is making sure you have the right tenant that has undergone proper vetting and after this, it is the 50 pieces of legislation you have to contend with next to make sure you are doing it right. If you are not sure then it pays to get the best advice first on all of the points about and more. This is where we excel.”

Fife Properties currently offer a FREE initial consultation service which not only provides an idea of the current rental value of your property but gives extremely useful advice on maximising your return of investment when renting. To book click the link: https://www.fifeproperties.co.uk/property-valuation/

The UK has the cheapest agent fees in Europe

For most of us, the purchase of a property will be the biggest single expense which we ever have to cover, and the fees associated with this are often touted as expensive. However, a recent report has shown that fees in the UK are the lowest in Europe and therefore the old myth of expensive fees has been debunked, with other parts of Europe up to five times more expensive than the UK.

The average commission paid on the sale of a property in the United Kingdom is 1.2%, according to analysis from GetAgent, which is lower than all other European countries, with Denmark and Ireland next cheapest at 1.25% and 1.75% respectively. On the other end of the scale is Romania with an average fee of 6% – five times more than the UK.

“I think it’s fair to say that estate agents in the UK have a tough time of it when it comes to justifying their fees, with the predominant opinion being that they charge too much for the service provided,” said Colby Short, GetAgent’s chief executive officer.

“This really isn’t the case and as this research shows, the UK is actually home to the lowest estate agent fees in the EU and therefore you could argue, the best service as well. Of course, the price of property means there is a degree of relativity and the 6% commission you might pay in Romania will be a lot lower due to the lower cost of getting on the ladder,” he pointed out.

“So while you consider if three to four thousand pounds is a justifiable spend when selling a property for hundreds of thousands, remember you could be paying upward of ten thousand if you were to live in another area of Europe,” he added.

Fife Properties Group Office Owner, Jim Parker commented, “Choosing an Estate Agent to sell your house will probably be one of the most important things you will ever do. While fees are important what is equally important is the end result. Having an Estate Agent that can demonstrate the ability to achieve more than the asking price on a consistent basis could far outweigh trying to save a few hundred pounds in fees at the beginning.”

Fife Properties currently offer a FREE initial consultation service which not only provides an idea of the current value of your property but gives extremely useful advice on maximising the value when selling. To book click the link: https://www.fifeproperties.co.uk/property-valuation/

15% rental rate rise predicted by 2023

The rental market in the UK has seen its fair share of changes over the last two years and it is now looking like those changes are starting to have an impact.

The Royal Institution of Chartered Surveyors (RICS) recently conducted a survey which provided some interesting forecasts for the Private Rented Sector.

It appears that the supply of homes available for rent has taken a fall and has done consistently for the past 2 years. Changes to tax law for landlords and an increase in stamp duty for buy-to-let purchases has made potential new landlords more hesitant to jump into the market.

RICS found that across the last 3 months 22% of respondents to the survey saw a drop in new landlords. This combined with the growing demand for rental homes due to affordability issues has led to forecasts of a 2% rise in rental rates over the course of the next year.

This increase is expected to be felt in all regions of the UK, with East Anglia and the South-West of England highlighted to see the largest growth.

Long-term, this is predicted to continue also, with the pressures of the UK property market predicted to drive rents up by 15% over the next 5 years.

A separate report from tenant referencing company HomeLet, stated that rents had risen by 1% in the 12 months to July, currently standing at an average of £777 per month, with London seeing a 3.3% rise to £1,615 in the same period.

Chief Economist at RICS – Simon Rubinsohn – commented on the findings of their survey, stating “The impact of recent and ongoing tax changes is clearly having a material impact on the buy-to-let sector as intended.

“The risk, as we have highlighted previously, is that a reduced pipeline of supply will gradually feed through into higher rents in the absence of either a significant uplift in the Build to Rent programme or government-funded social housing.

“At the present time, there is little evidence that either is likely to make up the shortfall.”

Fife Properties Lettings Director, Richard Cook commented, “Fife Properties have been lobbying the UK Government with the SNP and Scottish Association of Landlords since the new tax changes for Landlords were announced in 2016 but the UK Government is just burying it’s head in the sand. These tax changes are making it worse for tenants as we see more Landlords exiting the market and more tenants entering thus creating more demand and pushing up rents. This will not stop as it’s one on one economics of supply and demand. The Government should be embracing Landlords for helping them solve the housing crisis not penalising them.”

Top Tips For Viewing A Property Like A Pro

When it comes to buying property, it is important to keep in mind that it could potentially be the home you live in for the rest of your life. With this in mind, it is essential that when you view potential properties, you take the time to be thorough and get all the information you can.

To help make sure you don’t miss a thing and make the right choice when you do eventually make an offer, we’ve compiled the following list of tips to view a property like a pro.

Don’t rush

We all feel a bit strange viewing someone else’s home, but as we said earlier, you could be living in this property for decades so don’t rush through this process! It’s vital that you spend close to 30 minutes exploring the property, asking questions and just getting a good sense of how the property feels. If you just wander from room to room, taking a quick look and then moving on, you won’t get a good feel for the property. Taking that little extra time will mean you are well-informed when you come to make a formal offer for the property.

Think about how much space there actually is

When it comes to property space is one thing you can never have enough of. Whether you’re looking to fit in that Queen-size bed or you need somewhere to store all of the precious knickknacks that you have collected over the years, space is incredibly valuable. Pay attention to the way the current owner has laid out the furniture, as it will provide you with some insight into how to best make use of the property’s available space. It’s also an excellent opportunity to think about how much room your items take up and whether there is any scope for a little pre-move declutter.

Take a walk through the area

When you’re buying a property you’re not just investing in that building, you’re also investing in the neighbourhood itself. If you’re first-time buyers and looking to build a life in this new home, you have to ask whether the area is suitable for your family’s needs. Are there plenty of shops close by? How do the local schools perform? It’s best to wander around the area for a short while in order to see how it all feels, after all, if you’re going to be here for some time, you need to feel comfortable.

Once you’ve taken a good look, take another and maybe another

As we stated at the beginning, when it comes to buying property it’s best done the right way, but even when you do everything right, it’s always best to check things twice. No matter how thorough you intend to be there is always the possibility that you missed a couple of things the first time around. Most would advise visiting a property 2-3 times and at different times of the day – if possible – to see if you feel the same way each time. Buying a home can be very exciting, so it is worth visiting the property a few times.

Don’t forget that your agent is there to help you! Make sure you ask them questions about the property’s history and the local area, as they will be more than happy to assist you with your decision.

Fife Properties Managing Director, Jim Parker commented, “We always encourage and help buyers get as much information and facts as possible to help them make an informed decision after all for most of us this will be a home for many years to come.”